In any organization, handling revenue is vital for sustainable development and economic stability. The revenue period encompasses the entire method from the initial client interaction to the ultimate collection of payment. It involves numerous phases and actions that finally determine the economic wellness of the organization. In this article, we shall explore the revenue cycle in detail, discussing their key components, difficulties, and methods for optimizing economic performance.

Introduction to the Revenue Cycle:

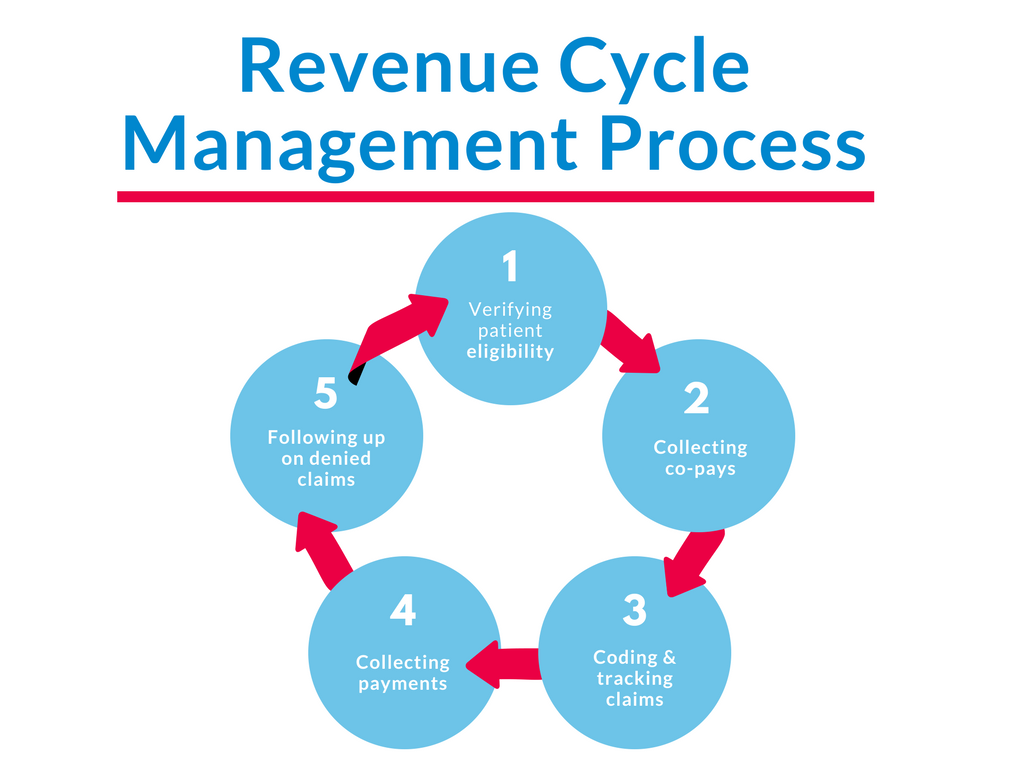

The revenue cycle shows the trip of revenue era inside an organization. It on average begins with lead generation and advertising efforts and advances through income, get control, invoicing, payment selection, and reconciliation. Each period in the revenue period plays a vital position in ensuring exact and appropriate revenue recognition.

Crucial Components of the Revenue Cycle:

a. Cause Era and Marketing: Attracting potential customers and producing attention about items or services.

b. Income and Customer Order: Changing brings into clients through powerful income techniques and negotiations.

c. Buy Running and Satisfaction: Obtaining and control client requests, ensuring correct item distribution or service fulfillment.

d. Invoicing and Billing: Generating invoices for items or solutions rendered, including appropriate pricing and terms.

e. Accounts Receivable Administration: Tracking and obtaining fantastic payments from clients, controlling credit terms and cost terms.

f. Revenue Acceptance and Confirming: Knowing revenue centered on sales axioms and regulations, ensuring precise economic reporting.

Issues in the Revenue Cycle:

Managing the revenue period successfully isn’t without its challenges. Some typically common difficulties include:

a. Incorrect Data and Certification: Incomplete or incorrect data may lead to setbacks in invoicing and cost collection.

b. Billing and Coding Errors: Problems in billing or code can result in cost rejections or delays, impacting cash flow.

c. Appropriate and Powerful Interaction: Not enough Provider Credentialing transmission between departments can cause setbacks or misunderstandings in the revenue cycle.

d. Complex Payment Methods: Coping with varied techniques, control costs, and reconciling transactions can be time-consuming and error-prone.

e. Submission and Regulatory Requirements: Sticking with industry-specific rules and sales requirements may be complicated and require constant monitoring.

Methods for Optimizing the Revenue Period:

To maximize economic success and assure a clean revenue pattern, agencies may apply the next techniques:

a. Streamline Operations: Identify bottlenecks and inefficiencies in the revenue cycle, and improve procedures to cut back setbacks and improve productivity.

b. Embrace Technology: Apply sturdy revenue cycle management computer software and automation resources to boost reliability, speed, and efficiency.

c. Increase Information Precision: Invest in data validation and quality get a handle on actions to minimize problems and mistakes in client information and billing details.

d. Improve Transmission and Relationship: Foster effective conversation and venture between sectors active in the revenue cycle to minimize misunderstandings and delays.

e. Check Essential Efficiency Indicators (KPIs): Build and track appropriate KPIs such as for example days sales remarkable (DSO), variety charges, and revenue growth to calculate and increase financial performance.

f. Staff Teaching and Training: Provide constant training and training to employees active in the revenue routine to ensure a heavy knowledge of operations, compliance, and most readily useful practices.

Conclusion:

The revenue period is a crucial facet of financial management and organizational success. By knowledge the important thing parts, issues, and utilizing efficient techniques, businesses may improve their revenue routine, enhance income movement, increase client satisfaction, and obtain long-term economic stability. Continuous monitoring, adaptation to industry changes, and a responsibility to method development are important for businesses to thrive in today’s competitive business landscape.