Forex trading, also referred to as international change trading, requires the buying and selling of currencies on the foreign exchange industry with the goal of making a profit. It is the biggest financial market globally, with an average day-to-day trading size exceeding $6 trillion. Forex trading offers investors and traders the ability to suppose on the fluctuation of currency rates, permitting them to possibly benefit from improvements in exchange charges between various currencies.

One of the critical options that come with forex trading is its decentralized character, as it works twenty four hours a day, five times a week across various time areas worldwide. This accessibility allows traders to participate in the market anytime, giving ample opportunities for trading across the clock. Additionally, the forex industry is very fluid, meaning that currencies are available and offered quickly and quickly without considerably affecting their prices.

Forex trading requires the use of leverage, allowing traders to manage bigger jobs with a lot less of capital. While power can boost profits, in addition, it raises the danger of failures, as actually little variations in currency rates may result in significant gains or losses. Thus, it is needed for traders to control their risk carefully and use appropriate risk management techniques, such as for example placing stop-loss orders and diversifying their trading portfolio.

Furthermore, forex trading offers a wide range of trading strategies and methods, including technical evaluation, fundamental evaluation, and feeling analysis. Specialized evaluation involves understanding old price information and using various signals and chart designs to identify developments and estimate potential value movements. Simple evaluation, on the other give, targets studying economic signals, news functions, and geopolitical developments to assess the intrinsic value of currencies. Feeling analysis involves assessing industry sentiment and investor conduct to anticipate adjustments in industry sentiment.

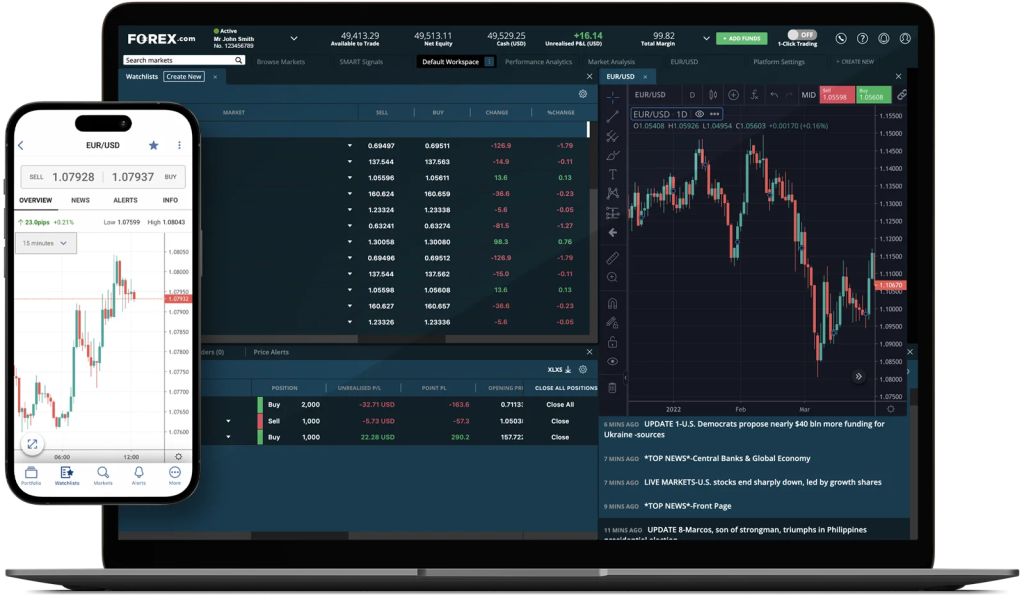

Moreover, advancements in technology have changed the landscape of forex trading, making it more accessible and efficient than ever before. Online trading tools and portable programs allow traders to perform trades, access real-time market knowledge, and check their roles from everywhere with an internet connection. Also, automated trading techniques, such as for example specialist advisors (EAs) and trading robots, can perform trades quickly based on pre-defined standards, reducing the need for handbook intervention.

Despite its possibility of profit, forex trading provides inherent risks, and traders should be aware of the problems and challenges connected with the market. Volatility, geopolitical events, and unexpected market movements can result in significant deficits, and traders should forex robot be prepared to manage these risks accordingly. Additionally, scams and fraudulent actions are common in the forex market, and traders should exercise warning whenever choosing a broker or expense firm.

To conclude, forex trading supplies a dynamic and perhaps lucrative opportunity for investors and traders to be involved in the worldwide currency markets. Using its decentralized character, large liquidity, and convenience, forex trading is becoming significantly common among individuals seeking to diversify their investment collection and capitalize on currency price movements. But, it is needed for traders to teach themselves about the marketplace, develop a stable trading plan, and exercise disciplined risk administration to succeed in forex trading over the long term.